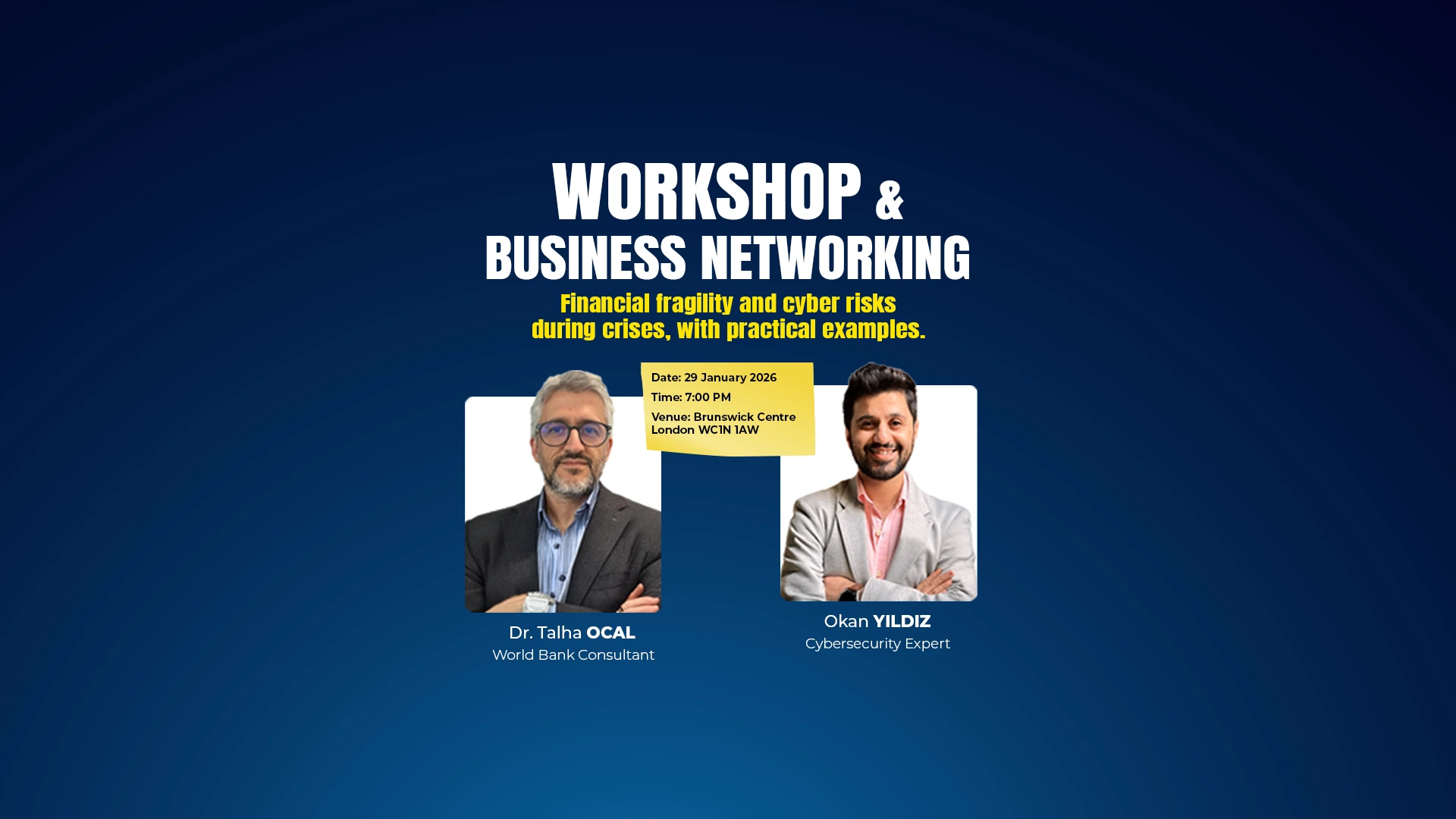

Corporate Finance & Cyber Risk Workshop

Turkish Business Forum is pleased to host its first workshop on Thursday, 29 January 2026, in London.

The workshop will address why corporate finance becomes fragile during times of crisis and why financial markets are a primary target for cyber attacks, through practice-oriented sessions delivered by two industry experts.

Programme

19:00 – 19:30: Dr. Talha Ocal

- Why does corporate finance become fragile during times of crisis?

19:30 – 20:00: Okan Yildiz

- Why are financial markets a prime target for cyber attacks?

20:00 – 20:30

- Q&A

20:30 – 22:00

- Networking & Refreshments

Workshop Content

Session 1 – Corporate Finance in Times of Crisis

- Why corporate finance becomes vulnerable during crises

- The cash flow, liquidity and profitability triangle

- Current macro-financial developments in the UK, Turkey and global markets

- The impact of interest rate, FX and demand shocks on corporate financial structures

- Common financial decision-making mistakes during crises

- Practical solutions for building financial resilience

This session focuses on practical financial management during crisis periods, analysing how rapid political, economic and financial developments—such as trade wars, interest rates, inflation, FX volatility and access to finance—affect corporate balance sheets and cash flows. Through real-life case studies, participants will leave with clear, actionable insights for their own organisations.

Session 2 – Cyber Risk in Financial Markets

- Why financial markets are a priority target for cyber attackers

- Attack surfaces across the financial ecosystem (banks, fintechs, payment systems, APIs and suppliers)

- Most common attack types and their impact on financial processes

- The link between cyber risk and market risk

- Recent UK case studies

- Regulatory and supervisory perspectives

This session demonstrates how a cyber incident can quickly escalate into operational losses, reputational damage, liquidity stress and regulatory exposure, ultimately turning into a market risk. Participants will gain practical guidance on risk prioritisation and action planning.

Speakers

Dr. Talha Ocal

Dr. Talha Ocal is an experienced finance advisor and executive with over 20 years of experience across more than 25 countries, primarily in emerging markets. He is one of the World Bank’s financial sector consultants and has advised multilateral development institutions, government bodies and NGOs on financial regulation and supervision, financial inclusion and access to finance, credit risk management, and digital finance and fintech. As a business executive, he has led M&A transactions and financial due diligence, structured and managed venture capital investment funds and real asset investments.

Okan Yildiz

Okan Yıldiz is a Principal Security Engineer at a global aviation technology leader, with over nine years of experience in cybersecurity. His expertise includes application security, DevSecOps, threat modelling and secure code analysis. Previously, he was a founding software engineer and Security Team Lead at an email security start-up and has provided cybersecurity consultancy across finance, healthcare and education sectors. He is the founder of UniqueSec, a non-profit initiative that has reached more than 3,000 participants across over 50 countries.

📌 Limited capacity

Event Useful Messages

Lorem ipsum dolor sit amet, consectetur adipiscing elit proin mi pellentesque lorem turpis feugiat non sed sed sed aliquam lectus sodales gravida turpis maassa odio faucibus accumsan turpis nulla tellus purus ut cursus lorem in pellentesque risus